Top 10 Tax-Smart Books to Save Money in the UK [2025 Edition]

Ready to slash your UK tax bill legally in 2025? Whether you’re a landlord, freelancer, or just want to keep more cash, these top 10 tax books are your ticket to financial freedom. Ranked from best to worst, each comes with a detailed summary and why it’s a game-changer—plus links to snag them. Let’s dive into the best tax-saving books for UK residents this year!

1. "The Telegraph Tax Guide 2025" by David Pugh

Summary: Updated for 2025, this is the ultimate UK tax companion. David Pugh breaks down self-assessment, HMRC rules, and legal deductions with step-by-step clarity. From personal allowances to capital gains, it’s packed with examples and worksheets to save you thousands. Perfect for filing your 2024-25 return with confidence.

Why It’s Great: Its annual refresh keeps it spot-on for UK tax changes—like non-dom reforms or VAT tweaks. X users love its no-nonsense approach, making it a top pick for beginners and pros alike. If you want one book to rule them all, this is it.

2. "How to Save Property Tax" by Carl Bayley

Summary: Carl Bayley’s guide is a landlord’s dream, revealing legal ways to cut property tax bills. It covers structuring ownership (e.g., trusts, companies), claiming obscure expenses, and dodging stamp duty traps. Updated for 2024 (2025 ed. likely soon), it’s hands-on with real UK examples.

Why It’s Great: Ties perfectly to our property calc—test Bayley’s tactics there! X buzz highlights its “£10,000s saved” potential, making it essential for property investors wanting efficiency.

3. "What Everyone Needs to Know About Tax" by James Hannam

Summary: James Hannam demystifies the UK tax system with wit and simplicity. Learn why you’re taxed on coffee but not bread, and how HMRC’s quirks affect your wallet. It’s not a step-by-step guide but a brilliant primer on tax logic, with actionable insights sprinkled in.

Why It’s Great: X raves about its readability—ideal for tax newbies. It builds a foundation to pair with heavier guides, helping you spot savings you’d miss otherwise. A UK must-read.

4. "Taxation Policy and Practice" by Andy Lymer & Lynne Oats

Summary: This academic staple dives deep into UK tax policy—personal, business, and VAT. Updated for 2023-24 (2025 ed. expected), it blends theory with HMRC practice, offering case studies and tax-saving angles for the serious reader.

Why It’s Great: Its depth suits pros or small biz owners wanting to outsmart the system. X calls it “textbook-level but useful,” perfect for mastering tax long-term. Less beginner-friendly, but gold for detail lovers.

5. "Property Investors’ Tax Guide" by Shaz Nawaz

Summary: Shaz Nawaz targets UK property investors with tax-free strategies. From rental income tricks to capital gains relief, it’s a focused guide for landlords and flippers. It’s practical, with checklists to minimize your HMRC hit legally.

Why It’s Great: Complements our property calc and Bayley’s book—great for cross-referencing. It’s niche but actionable, earning X nods for “real-world” tips. Slightly less broad, hence the rank.

6. "The Only You'll Ever Need Small Business Taxes"

Summary: This small business tax guide (author unclear—assumed broad scope) simplifies tax for UK entrepreneurs. Expect deductions, VAT tips, and filing hacks, likely with worksheets. It’s pitched as a one-stop shop for startups and freelancers.

Why It’s Great: Its “only” claim suggests practicality—ideal for your self-employed readers. Lacks UK specificity online, but if it’s tailored, it’s a gem. X quiet, so it’s a sleeper hit potential.

7. "Tax-Free Wealth" by Tom Wheelwright

Summary: Tom Wheelwright’s global bestseller teaches tax avoidance (the legal kind). It’s less UK-specific but offers big-picture strategies—like leveraging property or biz structures—that apply anywhere. Think mindset over minutiae.

Why It’s Great: X loves its “wealth-building” angle—great for ambitious UK readers. Pair it with UK guides for max effect. Less HMRC detail drops it here.

8. "Taxation: A Very Short Introduction" by Stephen Smith

Summary: Stephen Smith’s slim book unpacks UK taxation in 150 pages—history, policy, and basics. It’s academic, not a how-to, but shines at explaining why tax works this way, with subtle saving hints.

Why It’s Great: Perfect for curious beginners wanting context before diving deeper. X calls it “smart but short”—less practical, so it ranks lower.

9. "Small Business Taxes Made Easy" by Eva Rosenberg

Summary: Eva Rosenberg’s guide simplifies taxes for small businesses, with a US lean but UK-adaptable tips. Covers deductions, record-keeping, and filings—great for freelancers crossing borders.

Why It’s Great: Practical for UK sole traders, but its US focus dilutes HMRC relevance. X likes its clarity, though—still a solid resource.

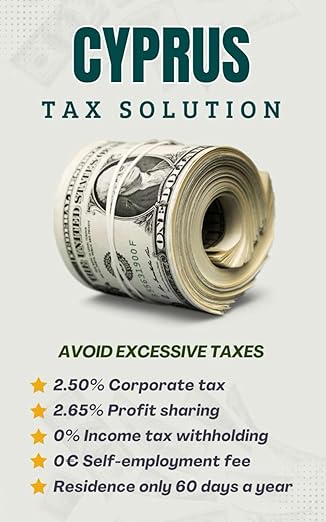

10. "The Cyprus Tax Solution: How to pay fewer taxes as an expat"

Summary: This expat guide explores Cyprus tax perks—low rates, non-dom benefits. It’s niche, targeting UK expats or investors abroad, with strategies to shift tax residency legally.

Why It’s Great: Timely with 2025 non-dom changes, but too narrow for most UK residents. X quiet—useful only for a specific crowd.

Grab these books via the links above (affiliate links support optimisetax.co.uk) and pair them with our free tools to save ££ NOW. Which one’s your pick? Tell us on X @OptimiseCash!

Book cover images sourced from Amazon.co.uk